To make expense administration easier, businesses usually look for a corporate expense debit card. With this card, the staff members of your company can make purchases for business purposes. Transactions are immediately logged for in-the-moment oversight and cost control. These cards are available from several advanced payment providers, but Valyuz stands out for offering superior quality.

Explore this Valyuz review to find out why its products are different from the competition and how they might benefit your company. By going through this review, you will find out why Valyuz stands out from the competition by offering premium corporate debit card solutions for effective expense management.

Delivering Customers with User Convenience and Ease

The corporate expense debit card from Valyuz is transforming the way that companies manage their money. Accepting this novel approach does away with the long-standing custom of staff members spending their own money to pay for company expenditures and having to wait a long time for reimbursement. This debit card relieves employees of their financial burden and is specifically designed to satisfy the specific needs of businesses. They may now pay for work-related expenses without having to take money out of their own pockets.

As a result, it eases the financial burden on them personally and promotes a more positive work atmosphere. However, the advantages go beyond this. Enhancing the company’s reimbursement process is a major benefit of integrating a corporate expenditure debit card into the expense management system. Tracking every company transaction in real-time and strictly regulating them eliminates the need for complicated paperwork or the chance of mistakes in expense reports. The organization benefits from this increased efficiency in terms of money saved, time saved, and a more efficient financial workflow.

Unparalleled Financial Effectiveness

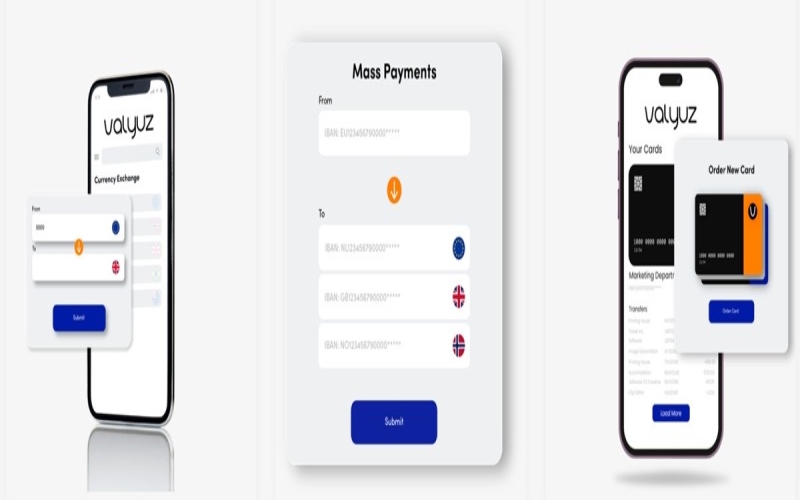

The business debit cards from Valyuz offer an even higher degree of efficiency and accuracy in terms of finances. These cards revolutionize how businesses manage expenses by digitally recording and categorizing transactions in a methodical manner. The creation of thorough financial reports is made easier by this electronic trail, which also expedites the spending reconciliation process. The transition from manual record-keeping to automated tracking is incredibly advantageous, as it saves a great deal of time by doing away with the need for laborious manual computations and data entering.

Organizing transactions neatly and making them easily accessible online significantly decreases the time and effort required to comb through receipts and documentation. Additionally, the switch to electronic recording reduces the possibility of human error that comes with handling expense data by hand. This increased level of precision in spending monitoring guarantees more trustworthy financial statements, which lowers the possibility of inconsistencies. Valyuz’s corporate expenditure debit cards, in short, provide a simplified option for companies looking to improve their spending management procedures while also increasing financial efficiency and enhancing the overall dependability and integrity of the company’s financial records.

Robust Cash Flow for Businesses

With Valyuz’s variety of business debit card choices and dedicated IBAN accounts, companies have an excellent way to make important purchases without using up all of their cash in hand. With their limited working capital, small firms and startups find this financial method very beneficial. Businesses may maintain a healthier cash flow by using these corporate debit cards, guaranteeing that money is always available for unforeseen crises, investments, and other operating costs.

This adaptability makes it easier to allocate funds more strategically, enabling companies to take advantage of expansion prospects. Valyuz’s debit cards for corporate expenses provide financial safety for startups and small businesses where careful resource management is essential. They provide these businesses with the financial flexibility they need to prosper and change in a cutthroat commercial environment.

Making it Easier for Users to Perform Transactions

The debit card programs offered by Valyuz go beyond simple transaction processing; they have strong analytical capabilities that provide insightful data on spending trends and patterns. These insights give firms a deep understanding of their spending patterns and enable them to make data-driven decisions. This knowledge facilitates their ability to recognize potential abnormalities in financial activities and pinpoint areas for cost optimization.

By gaining insight into spending trends, organizations may better manage their finances and establish budgets. These analytical tools turn into a strategic asset that helps companies find areas where they may save expenses and increase income. In the end, Valyuz’s business online debit card programs offer crucial information that gives companies a financial management advantage and greatly enhances their long-term profitability.

Final Thoughts

In conclusion, Valyuz distinguishes itself as a financial partner that offers creative solutions and comprehensive support to companies of all sizes. This dedicated IBAN account provider designs its services to meet the diverse needs of the ever-changing corporate environment. Whether that means facilitating international transactions, enhancing security protocols, optimizing expense management, or providing insightful information about expenditure patterns.